Receive your unemployment benefits direct deposit on Cash App

You may choose to receive your unemployment benefits by direct deposit or on a debit card. Prior to choosing how you would like to receive your benefits, you must review the debit card disclosure information that explains all the fees relating to the benefits card program.

How to sign up

You must sign up for direct deposit online.

- Sign up when you apply for unemployment benefits. You’ll need your bank or credit union account and routing numbers. They are displayed on your check.

- If you already have applied for benefits, wait 24 hours and then you can:

- Sign in to eServices.

- In the About me section, choose Update.

- Under I want to, choose Update payment information and follow the instructions.

Apply for, change or cancel direct deposit

Sign up for a Cash App debit card instead

Important updates - federal stimulus

On Dec. 27, 2020, the federal stimulus that changes and extends CARES Act unemployment benefits was signed into law. The Employment Security Department is working to deliver Washington’s Pandemic Relief Payment (PRP) program this week and the newly extended federal benefits, which begin the week of Jan. 3.

We’ll be updating this page with the newest info and sharing it on social media. Customers should watch for directions about the next steps via email and their preferred method of communication, eServices or postal mail.

For now, claimants should:

- Continue filing weekly claims. Learn more about filing a weekly PUA claim for the week ending Dec. 26.

- Watch for updates on this page and messages in eServices.

- Do not call our unemployment claims center with questions—call volume remains high.

If you absolutely must call the claims center about another issue, we encourage you to try throughout the day, and not just at 8 a.m. when we open. That’s when we receive the most calls.

Expanded unemployment benefits

Pandemic Unemployment Assistance (PUA)

Pandemic Unemployment Assistance (PUA) is a separate benefit program that provides a financial safety net to many people who do not qualify for regular unemployment, including:

- Self-employed people

- Independent contractors

- Part-time workers (with fewer than 680 hours)

- Available Feb. 2, 2020 - March 13, 2021

Benefit extensions

Pandemic Emergency Unemployment Compensation (PEUC)

Pandemic Emergency Unemployment Compensation (PEUC) is an extension of regular unemployment benefits that is available March 29, 2020 - March 13, 2021. It provides additional weeks of benefits on top of your regular unemployment benefits. Find out more about PEUC and other benefit extension programs you may qualify for after you run out of regular unemployment benefits.

Extended Benefits (EB)

Extended Benefits (EB) provides additional weeks after you have used up your regular unemployment and PEUC benefits.

About to Direct Deposit

We offer the option of having your benefits deposited directly into your checking or savings account. Most banks allow direct deposits but check with yours to be sure. Some banks and credit unions will not accept direct deposit, or they require that a special account number be used for direct deposit.

The programs that offer the direct deposit option are:

- Unemployment Insurance (and extensions)

- Trade Adjustment Allowances (benefits paid under the Trade Adjustment Act or TRA)

- Disaster Unemployment Assistance (DUA)

How to Setup Direct Deposit

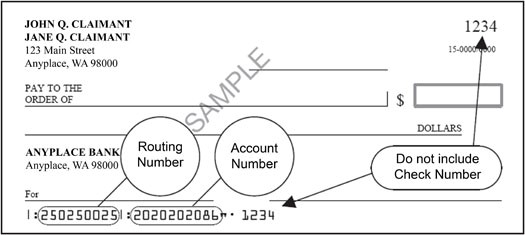

If you apply online for Unemployment Insurance benefits, you can enter your direct deposit information when completing the application. We will need the nine-digit bank routing number and your personal checking or savings account number (see below).

You can also start or change direct deposit at a later date. To do so, sign in to your account and selecting the Update Direct Deposit option from the dashboard.

If

you requested direct deposit when you filed your new claim online, you

do not need to sign up again unless you need to change your bank account

information.

How soon will I get my money?

We normally transfer funds to your bank account within two full business days after you certify for benefits. Payments will not be transmitted on bank holidays or weekends. It is your responsibility to verify that your benefits have cleared your bank account before writing checks or making debits against that account.

When dose direct deposit stop?

Your direct deposit will stay in effect as long as your claim is active. It will only stop if you change your payment method, or your claim becomes inactive. Claims become inactive when you don't certify for benefits for 28 days or more. If you reactivate your claim, you have to re-enter your direct deposit information. Otherwise, we will automatically switch your payment method to the prepaid debit card.

How to Change your direct deposit Account

Log in to your account and choose "Update Direct Deposit" from the "Manage My Claim" section of the dashboard. We cannot update this information over the phone.

If you want to switch from direct deposit to a debit card, fill out the "Authorization for Benefit Payment by Direct Deposit or Debit Card" form and send it back to us by mail or fax:

Unemployment Insurance, Checkmaster Unit

New Jersey Department of Labor and Workforce Development

PO Box 908

Trenton, New Jersey 08625-0908

Payments will continue to your existing account until the change is made. Account changes may take up to four weeks to process.

If we have problems making deposits to your account

Sometimes we can't make a direct deposit due to incorrect bank information. If your benefits are returned to us, we will temporarily stop your direct deposit and you will get a prepaid Bank of America debit card in the mail. Your benefits will be paid to that card account until you submit another authorization for direct deposit with updated information.

About the prepaid debit card

If you do not choose direct deposit, Bank of America will mail you a prepaid debit card. The card will come in a plain, unmarked envelope seven to 10 days after you file your initial claim. Watch your mail for it. The card comes with detailed instructions. Your benefits will usually be available in your debit card account within two business days after you certify each week. For more information, see our Bank of America debit card support page.

This card is good for four years. Keep it even after you return to work or your claim year ends. If you need to reopen a claim or file a new claim within four years, we will pay benefits to the same debit card account.

If you lose your card and need a replacement, call Bank of America at 866-213-4074.

Switching from debit Card to direct deposit

If you got a debit card but now want to get your benefits via direct deposit, you can update your preference from your dashboard. it may take a day or two to process an online request. If you the current week's benefits to be paid by direct deposit instead, sign up for a direct deposit, then wait until the next day to certify for benefits. If you sign up for direct deposit after you certify by phone, the current week’s benefits will be paid onto your debit card.

Hello

ReplyDeleteI Read your blog about Cash App Direct Deposit. Thanks for sharing such amazing information, and I hope you will share some more info about Cash App. You wrote really very well, I really like your blog and information provided by you. I will share this Information to other. But, If You want to know about How To Get a Refund On Cash App? then, visit us at: www.cashappdesk.com

The information mentioned in this blog is quite worthy. I just recommend everyone follow the prompts for the enable direct deposit cash app. Still, if you find any difficulty, you make seek quick assistance from the cash app desk. We make you understand how to send and receive money without a problem using our support.To know more, visit us at: www.cashappdesk.com

ReplyDelete